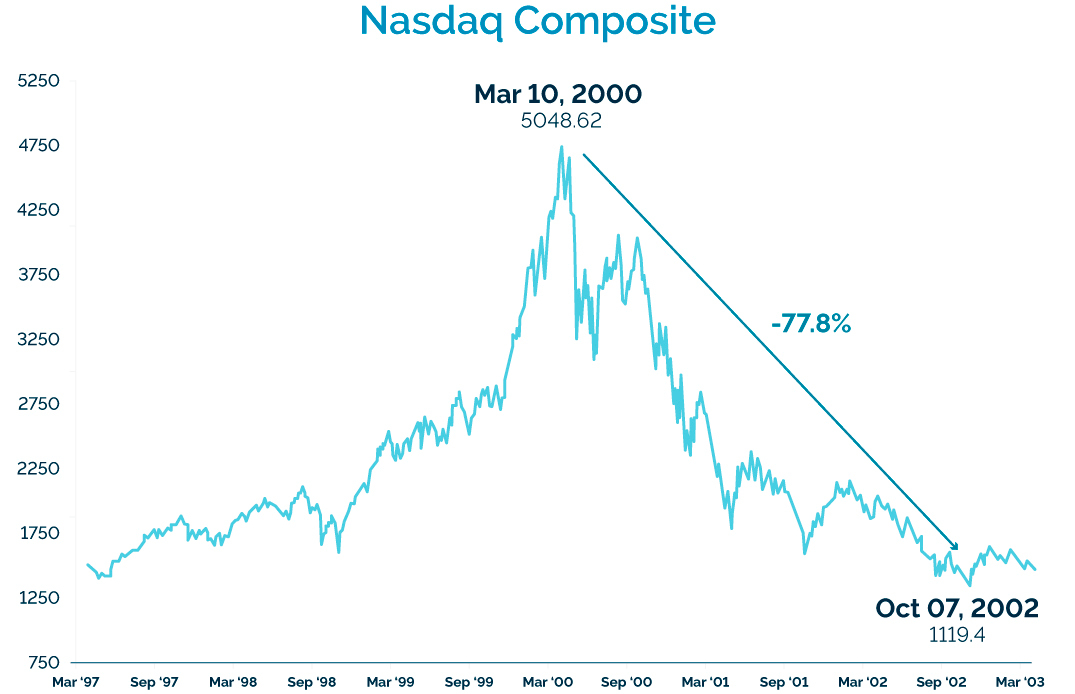

Don’t Party Like it’s 1999 – Memories of the Dot.com Bubble

The most challenging time I remember as an advisor was the late 90s. The frenzy was electric. New ideas emerged from every corner, the money was easy, the valuations were high, and everyone was chasing anything ending in dot.com. I remember how hard it was to be conservative in a world that rewarded speculation. At that time, earnings per share and profitability were looked down upon as relics of the financial past, much like the ancient practice of doctors that used to bleed people to cure them. The market has a way of curing bad ideas and in the year 2000, it did exactly that.

Today is a challenging time for investors to allocate capital because mega-cap U.S. tech stocks are almost as expensive in terms of valuation. They dominate passive indices, garnering as much as 35 cents of every dollar invested in the S&P 500.1 They permeate every portfolio as a top holding among most U.S. and international investors. Foreign ownership in this asset class is the highest it has been in history.2 But will foreign ownership continue to grow, or will international investors repatriate their assets to their home markets? We already see evidence of the tides turning as international equity markets have outperformed domestic markets year-to-date.

At the same time, countries around the world have little desire for fiscal sobriety. Instead, they have more debt than at any time in history. While the U.S. remains the most investable market, our balance sheet would not be the envy of the Dave Ramsey crowd. We are still the cleanest dirty shirt on Sunday morning.

There is a macro-economic trend that is also taking place. The Baby Boomers are changing from net savers to net spenders. The median age of Baby Boomers is now 70. By 2030, everyone in the Boomer generation will be over the age of 65. We have already started to see it in our little world, as net withdrawals of older clients are exceeding net savings of younger clients. The flow of money, which has been a major tailwind for stock prices, is making a shift to a headwind.

While it feels like a balloon floating to the top of a room full of sharp objects, I am not pessimistic at all about investing. I actually think it is one of the best times in my career to take advantage of opportunities. The narrow focus on the S&P 500, specifically the Magnificent 7 (Apple, Microsoft, Amazon, Amazon, Nvidia, Meta, Tesla), has opened a world of opportunities outside of technology. At the same time, investors are benefiting from higher interest rates, and international markets have presented a great value opportunity. It feels like a far cry from 2021, when we needed a magnifying glass to find the interest deposit in our bank accounts.

The interconnected world we live in causes shifts to happen quickly. Thanks to the ETF revolution, it has never been easier or less expensive to implement shock absorbers on the portfolio. Bringing in an expert on hedging could not have come at a better time.

At our July summertime learning event, Shawn Gibson, co-founder of Liquid Strategies, discussed the Overlay Hedged US Equity Fund (OVLH). You can listen to him present to a roomful of clients in the slide show below. I hope you will find it as interesting as I did.

In hindsight, I will always be grateful for the lessons from the dot.com bubble because it taught me to stay committed to common sense and diversification even in the most challenging, speculative markets. Fortunately, we have better tools to mitigate the downside rather than just avoiding the market and missing out on some of the fun.

Footnotes:

1. How much of the S&P 500 do the Magnificent Seven account for? Fool.com

2. Record-High Foreign Ownership of the US Equity Market AppoloAcademy.com