Solving the Mystery of Lifestyle Cash Flow

Lifestyle Cash Flow is the linchpin of your Point of Independence. Yet when I ask, “How much after-tax cash flow does it take to support your family each year?” very few people know the answer. In our Blue Pages we call this number Lifestyle Cash Flow. It represents the sum total of every dollar spent whether it be mortgage, property taxes, vacations, tuition, etc. Every month, quarter and year, you have to fund the Lifestyle Cash Flow regardless of market conditions, job security, death or disability. Paying the bills is a requirement, not an option. And unfortunately the world does not care if you have a problem.

With the advent of programs like Quicken, Mint and online banking, one might think that it is easy to track your Lifestyle Cash Flow. But every week I am reminded by really successful people just how difficult it is to get a true number. While these programs may enable us to track every penny, our working memory can only handle about 3 or 4 simultaneous thoughts. This is why your 10 digit phone number is broken up into 3 and 4 number blocks. We understand 404-257-3317 but not 4042573317. Quicken and Mint don’t help because they create too many categories, violating our ability to understand. So I am going to suggest two simple systems to help utilize these programs.

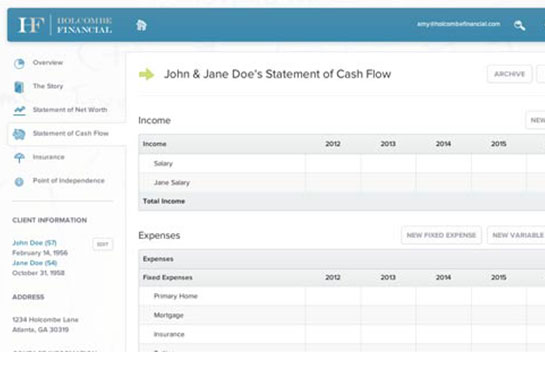

First, eliminate every subcategory that they want you to track. It does not matter if the house utility bill is $200 per month and the taxes are $5,000 per year. What matters is the after-tax cash required to run the house annually is $24,000. Map all expenses related to the house to your Home category. Add up all the mortgage payments (less escrow because those are Home category expenses) and call it Home Mortgage. Map all expenses like travel, clothes, food etc to the Personal category. Many of our clients use a credit card for all of these expenses. In that case the credit card is in effect the Personal category. Map all the insurance expenses to Insurance, charitable donations to Charity, etc. Try to keep it fewer than ten to fifteen categories so you don’t violate the working memory function of the brain.

Second, you need a control group to make sure the above calculation is correct. And it requires forcing simplicity. Create two bank accounts for the family. One account will receive all the income and one account will pay all the bills. Each month transfer money from the income account to the expense account to pay the bills. At the end of the year, your income account should match the Personal Profitability from the Blue Pages and the expense account should match the Lifestyle Cash Flow number. The only discrepancy should be your income tax. If it does not match, something is incorrect on your Lifestyle Cash Flow statement. But at least you know the problem and that is 90% of the battle to get things right.

Don’t spend the time on trying to fix history. Set this method up for new transactions, and in one year you will have all the data you need. These simple steps will help make it easy to answer the most important question underlying your Point of Independence.