Building & Maintaining Resilient Wealth

Resilient wealth creation is the purpose of investing. We all want our wealth to grow, provide income and to protect our freedom to do what we want, when we want. And, at the end of our journey, we want to leave a legacy for our kids. Over the last 5 years, we made some meaningful changes to the portfolio. From the fallout of rising rates in 2022 to the market cleansing reaction to Liberation Day in April, you have largely sidestepped these events. Performance in your portfolios this year is a reflection of these changes.

“The majority of people don’t actually want to be rich; they just want independence to choose what to do with their days and not put up with meaningless [stuff].” Trader Ferg

Adapting to Change: The Future of Your Money

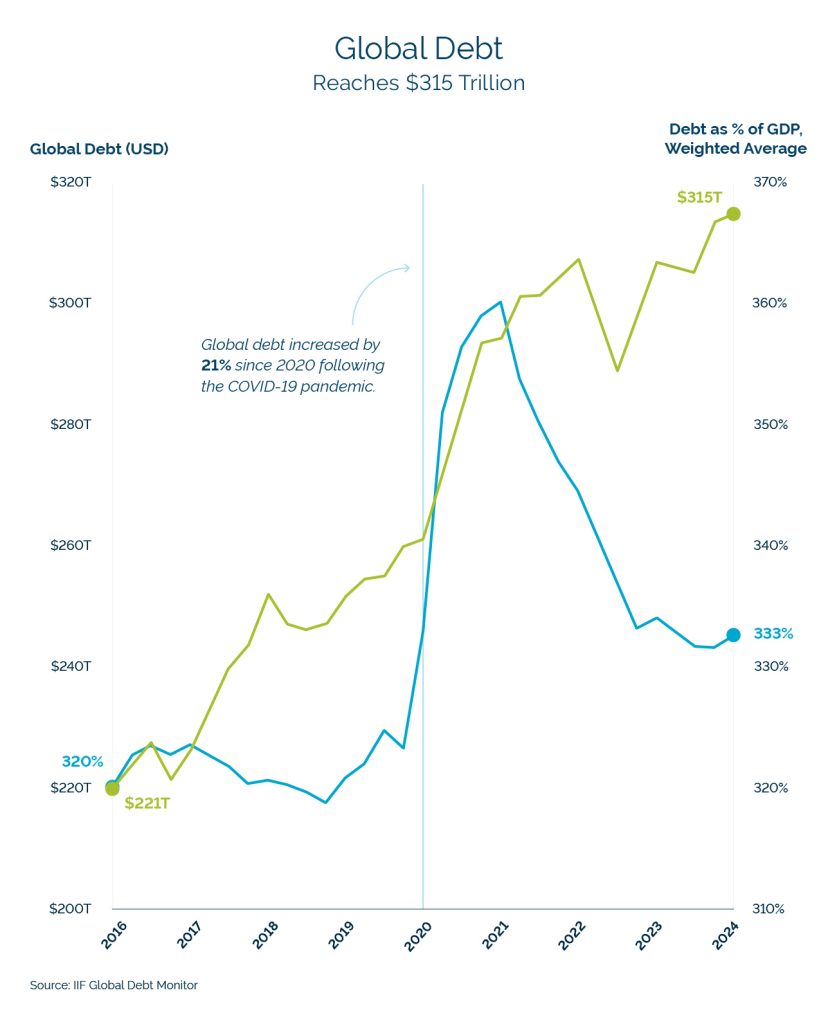

In the 1990’s, there was a corporate credit crisis. In the early 2000’s, the internet bubble burst. In late 2000’s, there was a housing crisis. Today, I think, we could argue there is a sovereign debt crisis. This brings us to what worries us.

Fiscal sobriety as a moral compass seems to be lost in every country in the world. China, France, USA, Germany, UK and Japan have all recorded record increases in their debt levels in USD terms.

Note: (The number above is now $338 Trillion).

A fiscal drug normally reserved for harsh economic times is now being administered into an already inflationary trend.

When we think of fiscal deficits, it is really a fiscal stimulus because the government is spending in excess of projected tax receipts. The money supply expands. Interest, which is a non-negotiable payment, will exceed $1 trillion per year next year. Incurring additional debt to pay interest into perpetuity rarely ends up in the success manual.

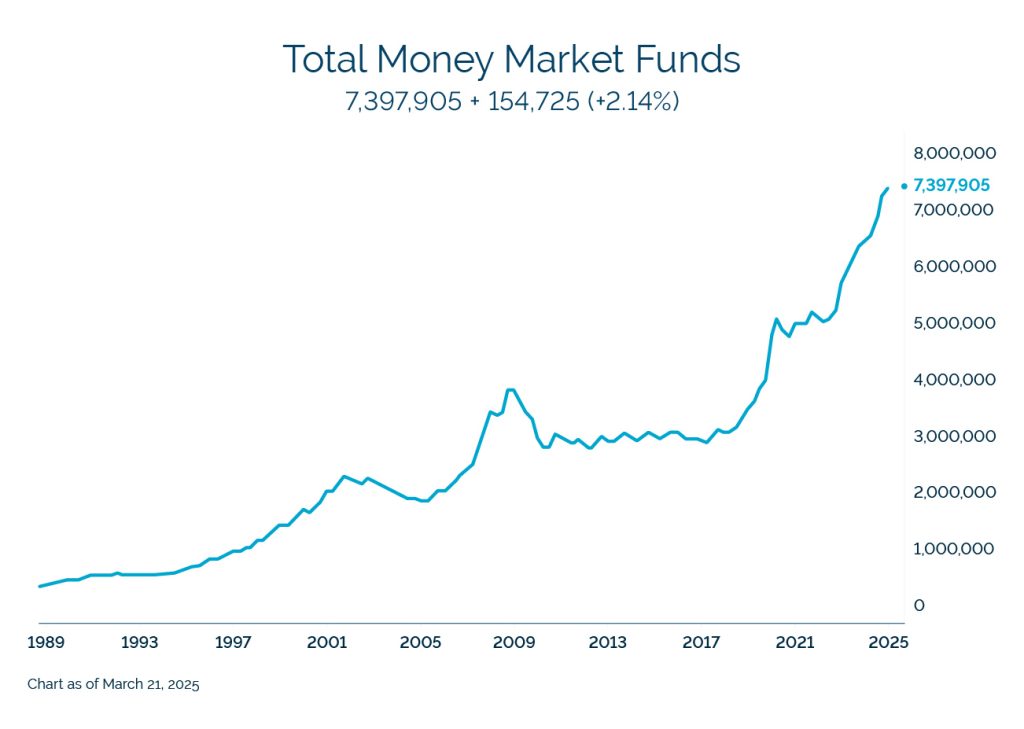

To put this idea of expanding deficits into context, imagine owning a stock paying 4% dividend per year. At the same time, the company is issuing new shares and growing those shares outstanding at 6% per year. The stock price would eventually be worth very little. But investors “comfortably” collect 3-4% on the government-backed money markets while a printing press erodes the very foundation underneath their feet.

Governmental Solution

Since nobody wants to make the hard decision either at the political or societal level, printing money seems to be the silent solution and every country in the world is following suit.

Scarcity

The good news is that we have been here before; it has just been awhile. (If we spoke Turkish or Portuguese, the memory would not be so distant.) On Sunday August 16, 1971, President Nixon was in office and a French ship (it was not a battleship as historical accounts like to dramatize things) arrived in Manhattan to take their gold back.

He [Nixon] suspended convertibility of the US dollar into gold, effectively ending the 25-year Bretton Woods era of fixed currency exchange rates against the US dollar. US gold reserves were facing enormous pressure due to balance of payment concerns, the Vietnam War debt and Great Society programs, and the ensuing monetary inflation. A growing number of countries began to redeem their dollar holdings for gold.

In addition, the German withdrawal from the Bretton Woods agreement sparked panic and a currency crisis. By the end of June 1971, $22 billion in assets had left the US. In July 1971, Switzerland redeemed $50 million for gold and one month later in August, pulled its Swiss Franc from the Bretton Woods agreement. At the same time, France redeemed $191 million for gold by sending a French “battleship” to New York to take delivery of the gold from the Federal Reserve and to bring back to France.

In inflationary times, scarcity becomes important. The best assets not only maintain their value but likely increase in value because their quantity is fixed. As the metric of exchange expands so does the price of a scarce asset. We have seen this impact the price of the best real estate and the stock market. These prices have skyrocketed over the last 5 years as the COVID response dropped helicopter money from the sky. The most scarce things became the most valuable things.

Which brings us to hard assets like gold, silver, platinum and other critical commodities. Scarcity is in their DNA.

The Original Monetary Mandarin

The history of gold spans over 5,000 years. No country has outlived it. The supply is limited. Global gold mined since inception is estimated at 206,000 tons with 62,000 tons left to extract. The entire above-ground worldwide supply will fit inside less than 4 Olympic size swimming pools. The supply of gold grows by less than 1% per year. And most importantly, people normally don’t borrow money to buy it which we can’t say for Bitcoin.

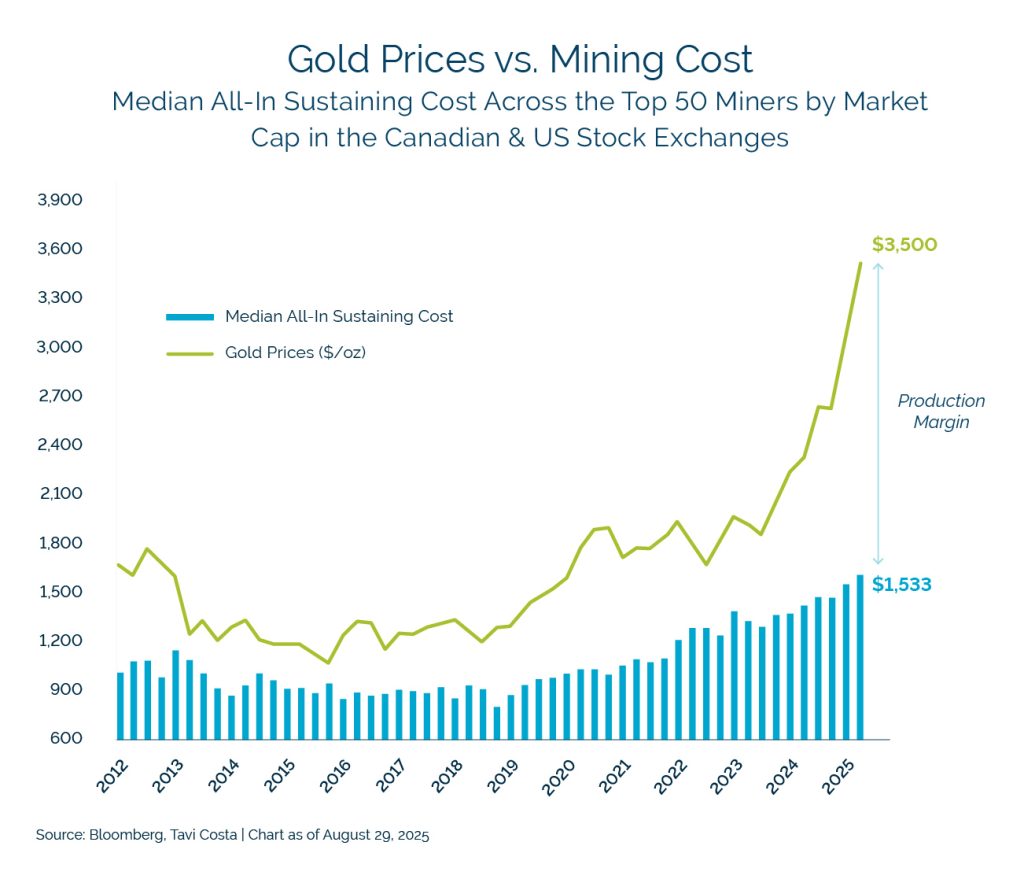

The price of gold has made gold mining companies the most profitable companies in the world. The profits below were at $3,500 per ounce and at the time of writing this newsletter, we are over $4,000 per ounce, so the margins are even greater now. (Source: Metals and Mining substack)

Imagine if Apple generated $2,500 profit on every iPhone sold. That is what’s happening in gold mining right now.

Because the vast majority of the costs are fixed costs, an 18% increase in the price of gold increases the margins by 25-50% depending on the miner. But most importantly, gold has a long track record of protecting its owners against monetary foolishness.

Allocation Update

Over the last 5 years, we diversified the against the systemic risk caused by the Mag 7. We bought interest-rate protection against the backdrop of ZIRP (Zero Interest Rate Policy). And, to protect your purchasing power against currency debasement, we added gold miners/gold to the asset allocation back in April. We have been expanding the commodity bucket to a modest 5% allocation by taking some of the profits generated from both fixed income and a decade-long run of US growth.

If scarcity continues to drive price into an inflating world, it should partially protect us against monetary excess by those that lead us and hopefully round out the 4-legged stool of resilient wealth.

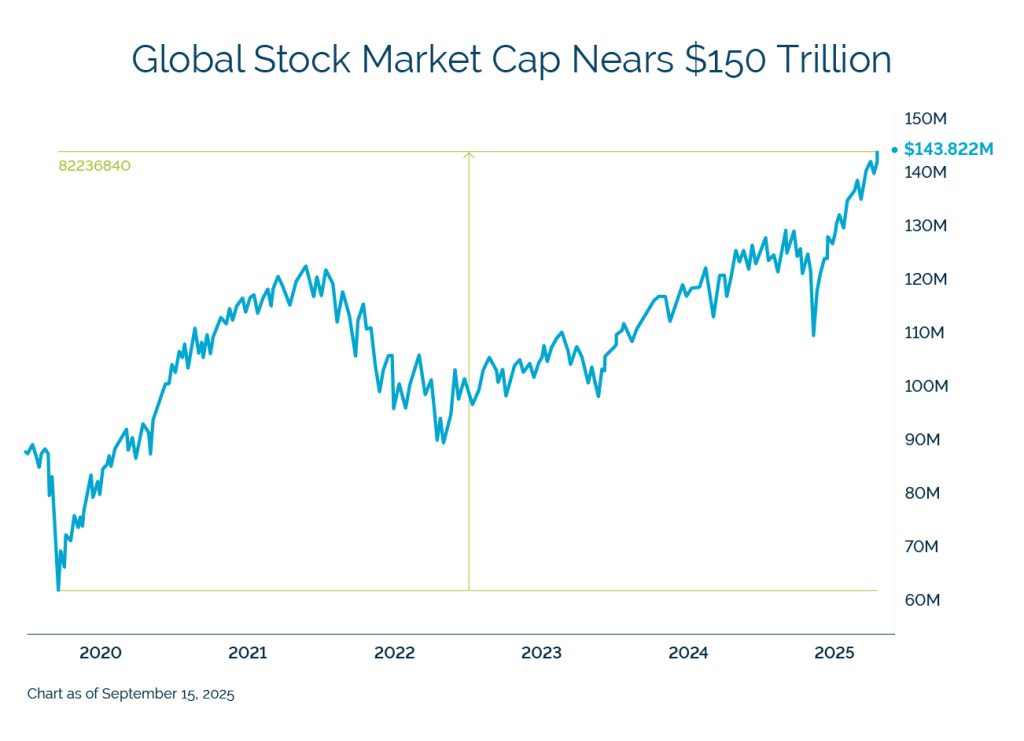

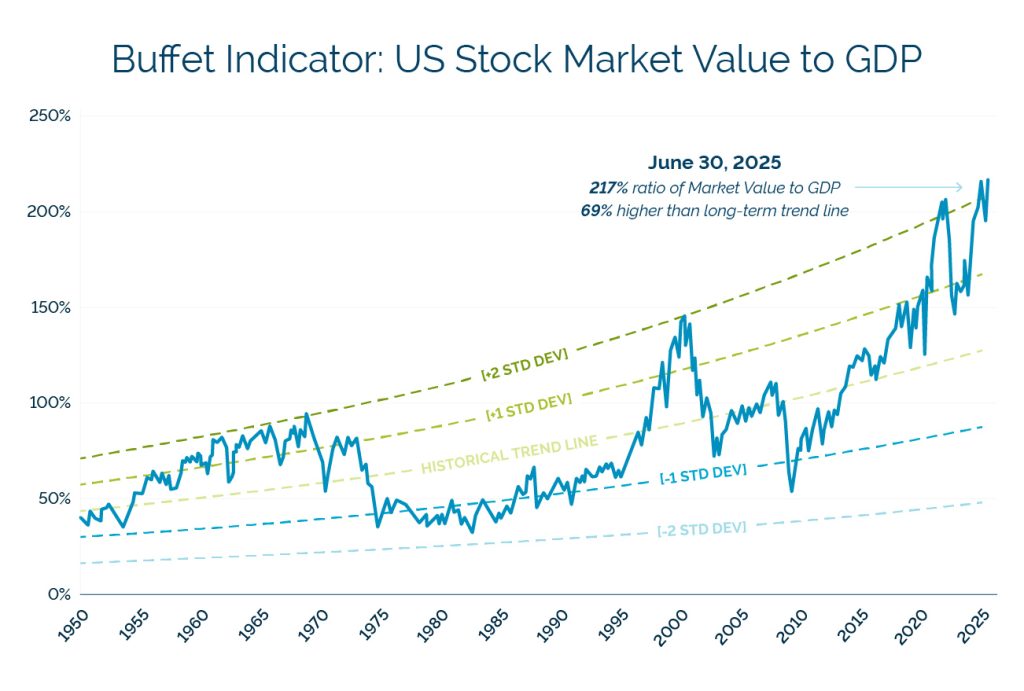

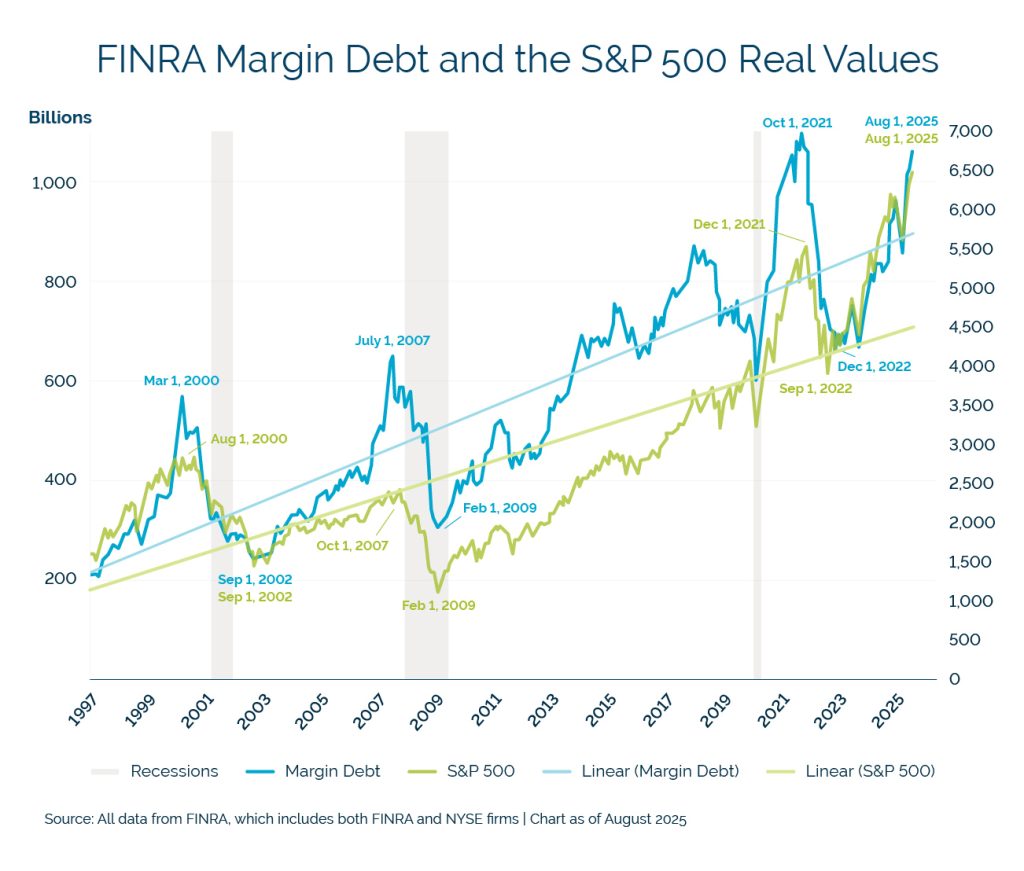

I have shared some charts that I found interesting about the state of markets below.