2025 Results & 2026 Macro Landscape

When it comes to investing, I am a contrarian and value manager at heart. From a wealth management standpoint, a hypersensitivity to risk and a desire to avoid overpaying probably summarize our philosophy. When the Fed began juicing liquidity to “save” the economy in “08-’09, the era of asset appreciation began. We started this period with a heavy focus on passive management and short-duration bonds. We ended it with an equal focus on active management and mid-duration bonds. It required some shifts along the way to sidestep the expansion of risk in the backdrop of ZIRP (Zero Interest Rate Period), the 2022 Fed hikes that left many (not you) with a hole in their portfolio, and Liberation Day, where active management/international investing actually benefited from the debasement of the dollar.

Investing is a long game, and 2025 was the reward for your years of patience with international investing, value investing, and basically adhering to rational finance. I could not be happier with the results. Performance is always a tough thing to share in a newsletter from a regulatory perspective. I recommend reviewing your quarterly report for last year at the link below, and reviewing the performance of fixed income, international, equity income, and the addition of hard assets. It was a great year.

Looking Ahead to 2026

I wish I had insight into the strategic goals of the Administration. It is a very charged issue. I am only focused on the scientific aspects and how it could impact the investing landscape over the next 12 months. It reminded me of a Voltaire quote:

“Uncertainty is an uncomfortable position, but certainty is an absurd one.” – Voltaire

Uncertainty creates opportunity. If that is true, opportunity is everywhere. As we embark on the new year, Inflation and Energy are the themes. We continue to maintain our international exposure, dividends as the primary metric of value, maintain our current under-exposure to large-cap growth (i.e., Mag 7) and longer duration fixed income with a hedge against rising long-term rates.

The Risk of Holding “Too Much Cash”

The Treasury is dancing the same Berneke/Yellen two-step that got us into this mess in the first place. To be honest, Bessent did not have a choice. Nobody wants to buy $38 trillion of US 30-year bonds, and we continue to run 6-7% deficits. Therefore, the borrowing on the short end of the yield curve continues. It is the equivalent of a payday loan. The interest payments on the national debt exceed $1 trillion, and that number is growing. The Treasury needs to keep the financing cost now, so the era of Japanese-style Yield Curve Control seems to be the only exit from this Puzzle Room. It worked for over 30 years for Japan, but they are paying the price now.

The new Fed chair arrives in May, and after this week’s developments, who knows how this story ends. On the housing front, major stimulus appears to be coming to the housing market in 2026 to battle the affordability problem. Low interest rates will likely be integral to this program.

This makes cash a challenging investment. If the purchasing power of the dollar continues to decline as debasement continues, the real rate of return (yield minus inflation rate) will be negative for cash. Prices of goods will increase faster than the rate of return. It may feel like earning 3.25% on cash is great, but it is not keeping up with the inflationary trends. Cash reserves should be kept at the target reserves, and excess cash should at least be invested in short-term inflation protected Treasury bonds to protect purchasing power.

Economy Risks Running Hot: Inflation

It is clear that the President is focused on the midterms. The stock market seems to be the metric. The last time Bessent spoke about the stock market not being a priority for the Administration was in April of last year, after the selloff following the “Independence Day” tariff announcements. In our consumption-based economy, the wealthiest 10% of Americans are responsible for almost 50% of consumption. Most of their wealth is based on asset price inflation (real estate, stock market) since 2010. If the stock market falls, it will hurt consumer spending, which hurts the economy, and as a result, decreases their chances of winning the midterms.

Lower energy prices are a way to combat inflation, and that is a clear priority of the Administration. Energy accounts for only about 2.8% of the S&P 500 and has suffered from major underinvestment over the last 30 years. To provide some perspective on the changes in priority, in the 1980s, energy represented 26% of the S&P 500. Energy is the raw material of the internet and is gathering momentum.

The Case for Commodities

I will not pretend to be an expert in the world of mining but Substack provides access to some very smart people that write about the challenges.

Over the last 30 years there has been a massive underinvestment by Western countries in the production and processing of raw materials. Copper, silver, etc. are in structural deficits unable to meet the needs of the current system. There is a trifecta of events happening right now and all are competing for the same input. The AI data center construction boom, the required electrical grid upgrades to transmit power to these centers, the electrification of transportation and a worldwide focus on re-militarization all compete for the same resources. And those resources are already in a structural deficit.

Separation Bottleneck

But mining itself is not the main challenge. The real bottleneck lies in Separation – the hazardous, intricate, and power-hungry process required to chemically isolate rare earth elements from each other.

From a geological perspective, rare earth elements rarely exist in isolation; they form combined mineral structures like bastnaesite or monazite. Their separation demands extensive solvent extraction (SX) capabilities. This involves dissolving minerals in corrosive acids and processing them through hundreds or thousands of mixer-settler stages, where specific solvents extract individual elements based on subtle atomic weight variations. This generates substantial acidic waste and mildly radioactive byproducts (from thorium content). From Trader Ferg

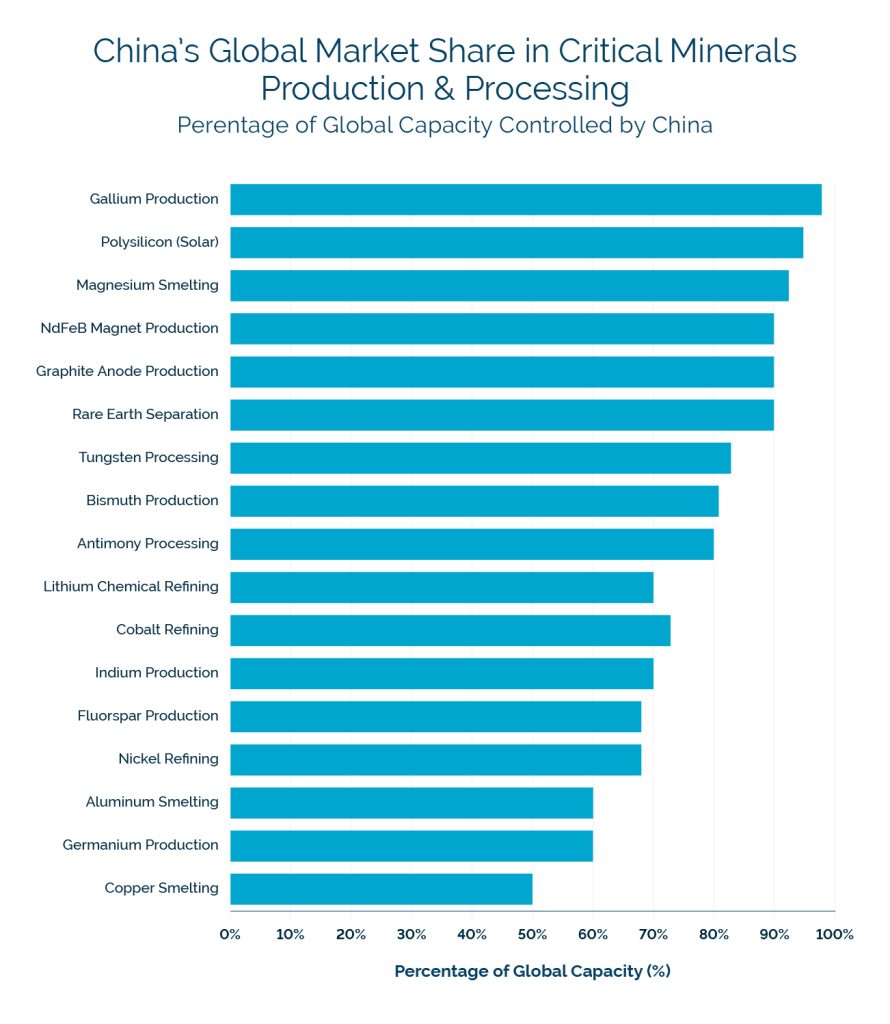

Looking at 2025 figures, China’s dominance in processing capacity stands unmatched in industrial history.

Even if the Western world owns the mine, it has to ship the product to China for refining and then buy it back in its useful form. America faces significant hurdles in overcoming existing regulations and local opposition to eliminate this supply chain bottleneck. Nobody wants this in their backyard. The Administration acknowledged this bottleneck at Davos World Economic Forum and even said rare earths are not really that rare. Processing them is rare and the chart below highlights the dominance of China in this space.

These problems will not resolve themselves overnight. According to Craig Tindale, the average global timeline for a new copper mine is approximately 17 years. In the United States, it is 29 years. The projected demand for copper by 2028 would require an additional five to six giant copper mines that don’t exist. The move to clean energy, the AI revolution and global rearmament all happening at the same time is putting a lot of pressure on pricing of raw materials.

We added a 5% position to commodities/gold last year and will likely expand this exposure with a focus on industrial metals and energy as an inflation hedge.